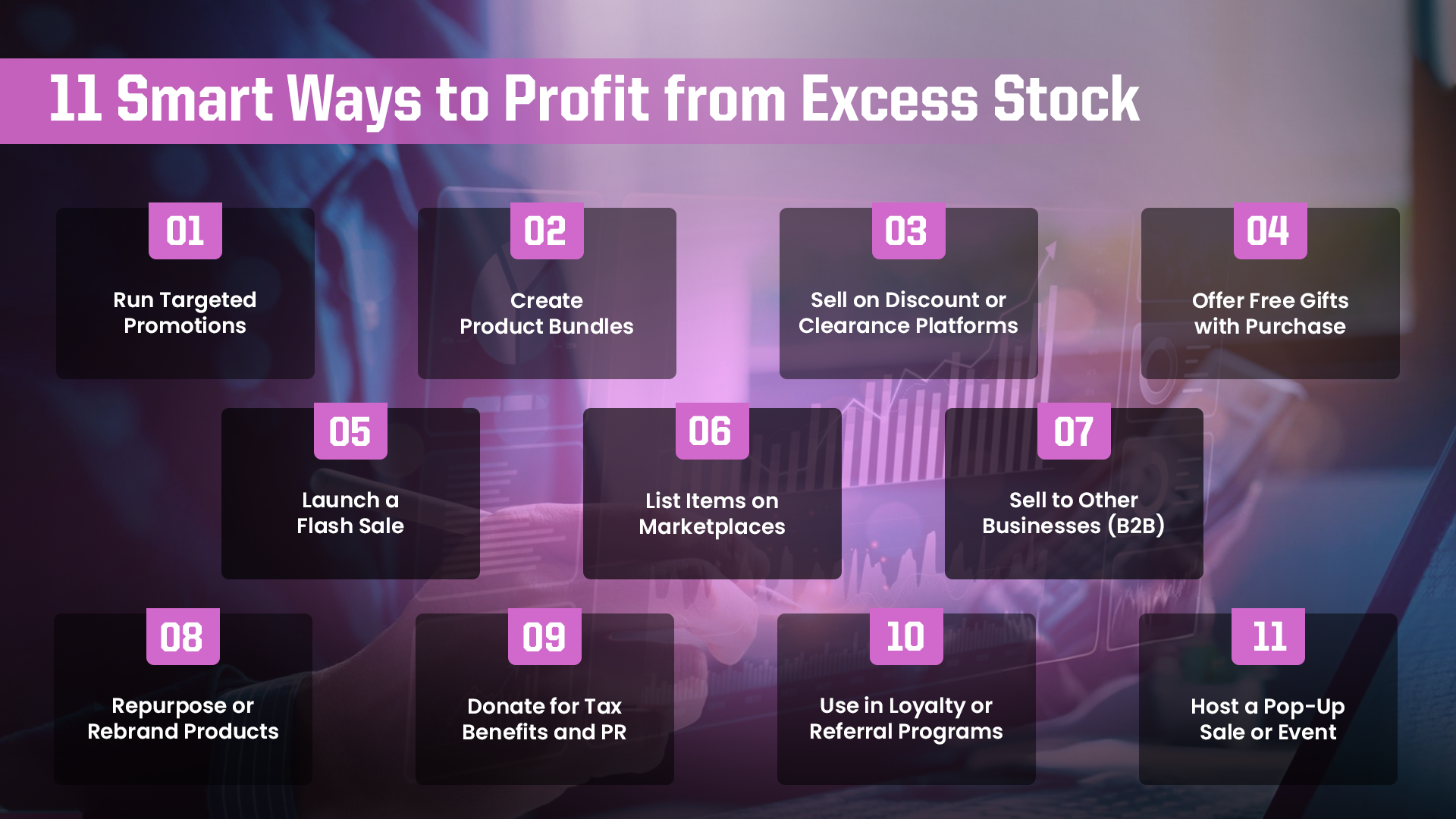

11 Smart Ways to Turn Excess Stock into Profit: A Guide for Small Businesses

If you’re a small business owner sitting on piles of unsold stock, you’re not alone. Many businesses face the same challenge—what to do with excess inventory that ties up valuable storage space and cash flow. But here’s the good news: your surplus stock isn’t a loss. With the right strategies, it can actually become a source of profit.

This is where Investment Recovery steps in. Investment Recovery is the process in which one retrieves the greatest potential value from underutilized, redundant, obsolete, or unused business assets. It’s not just about selling excess inventory items—it’s about turning what seems like waste into working capital.

In this guide, we’ll walk you through 11 smart and practical ways to turn excess inventory into real profit—and how investment recovery plays a key role in each step.

What Is Investment Recovery?

Investment Recovery refers to the reclaiming of value processes revolving around idle, surplus, obsolete, or unused assets in a business. The main goal for any business is to gain profit, however profit might not be obtained in a straightforward manner. This is the reason why Investment Recovery is so important. Instead of simply letting stock sit unattended to, it can be resold and repurposed for profit.

If you have expired materials or retail stock, adapting the Investment Recovery approach will allow you to recover those values and reinvest it into your business for future growth. Combining both approaches enables faster recovery from certain investments, especially when their goals are clearly defined. This is why making profit out of losses is a prominent theme here. Let’s explore together 11 methods through which accessible stockpiles can be turned into profits.

Run Targeted Promotions

Short-term promotions are one of the most effective tools to quickly move excess inventory. Whether it’s a seasonal sale, a “Buy One, Get One Free” offer, or a time-limited discount, promotions create urgency and spark interest. Make sure to promote the sale through multiple channels—email newsletters, social media, in-store signage, and your website.

Example: A clothing retailer can sell overstock inventory to clear out winter stock in spring by offering a 40% off clearance event advertised via SMS and Facebook ads.

Investment Recovery Insight: Promotions help recover partial investment while freeing up space and resources. Even if the margins are lower, the recovered capital can be reinvested in fast-moving stock.

Create Product Bundles

Bundling is a great strategy to increase perceived value and move slower items alongside best-sellers. Instead of marking down the slow seller alone, group it with a popular item and offer the pair at a special bundle price.

Example: A skincare brand can bundle an unsold toner with their top-selling moisturizer and inventory sell the set at a slight discount.

Investment Recovery Insight: Bundles reduce stock while boosting average order value. They also allow you to capture the full or near-full value of slower-moving inventory in a fresh context.

Sell on Discount or Clearance Platforms

If your existing sales channels aren’t moving old inventory, list it on third-party platforms designed for bargain shopping. Sites like eBay, Overstock, Amazon Warehouse, and even your own clearance page cater to value-conscious buyers actively looking for deals.

Example: An electronics store with older headphone models can list them on eBay to reach a broader audience.

Investment Recovery Insight: These secondary markets may offer lower margins, but they open new opportunities for recouping value from inventory that’s otherwise stuck.

Offer Free Gifts with Purchase

Everyone loves freebies. Instead of discounting, you can use extra stock as a free gift for customers who meet a spending threshold. This encourages higher order values while maintaining product pricing integrity.

Example: A tea company can offer a free mug (from slow stock) when customers spend over $50.

Investment Recovery Insight: Free gifts increase customer satisfaction and retention while silently offloading excess stock—turning liabilities into marketing assets.

Launch a Flash Sale

Flash sales are high-impact, short-term promotions that create urgency. These time-sensitive deals (24–48 hours) should be well-marketed through all digital channels. Use countdown timers, bold visuals, and strong calls to action to maximize conversions.

Example: A home décor shop announces a weekend flash sale on surplus lamps with 30% off, using Instagram Stories and email blasts.

Investment Recovery Insight: Flash sales are great for quick disposal of unsold stock while generating fast revenue. They’re also excellent tools to bring back dormant customers.

List Items on Marketplaces

Expanding your reach through popular online marketplaces helps tap into a wider customer base. Marketplaces like Amazon, Etsy, Facebook Marketplace, Walmart Marketplace, and niche-specific platforms offer a cost-effective way to resell.

Example: A toy seller lists unsold educational games on Amazon with optimized product listings and competitive pricing.

Investment Recovery Insight: Diversifying sales channels increases visibility and reduces dependency on one source—crucial for recovering investment from inventory that may be invisible on your primary storefront.

Sell to Other Businesses (B2B)

Bulk selling to other businesses—such as local retailers, resellers, wholesalers, or event organizers—can help you clear stock faster than individual sales. This is especially effective for non-seasonal or consumable products.

Example: A kitchen supply company offloads excess cutlery sets to local catering services.

Investment Recovery Insight: B2B sales often mean larger transactions, faster turnover, and less handling. This method also opens the door to long-term partnerships and recurring revenue.

Repurpose or Rebrand Products

Sometimes a product just needs a new look or angle. Consider updating the packaging, changing the product’s use case, or rebranding it for a different audience or season.

Example: A stationery store rebrands leftover journals as “Gratitude Books” with updated covers for a wellness campaign.

Investment Recovery Insight: Repurposing transforms overlooked inventory into fresh offerings. It’s a low-cost way to extend product life cycles and renew demand.

Donate for Tax Benefits and Public Relations

If your products are still in good condition but just not selling, donating them can be a win-win. Charities, schools, shelters, and nonprofits often need goods. Donations can offer tax deductions while positioning your brand as socially responsible.

Example: A shoe company donates last season’s models to a homeless shelter and receives local media coverage.

Investment Recovery Insight: Strategic donations turn unsold stock into value—both financial (via tax breaks) and reputational. It’s a smart exit for obsolete but usable items.

Use in Loyalty or Referral Programs

Add value to your loyalty and referral programs by using surplus business inventory as gifts or rewards. It’s a great way to increase engagement, strengthen customer relationships, and clear unused items.

Example: A coffee brand offers a free mug to customers who refer two friends or reach a loyalty milestone.

Investment Recovery Insight: Giving slow stock to loyal or referring customers improves retention and enhances brand loyalty—while recovering value from stagnant goods.

Host a Pop-Up Sale or Event

Pop-up sales—whether online, at community markets, or in-store—are great for creating buzz and moving extra stock. These events can be tied to local festivals, holidays, or store anniversaries.

Example: A pet supplies store hosts a weekend pop-up booth at a local fair to clear out overstocked leashes and collars.

Investment Recovery Insight: Pop-up events combine brand promotion with quick inventory turnover. They’re excellent tools for high-energy community engagement and fast asset conversion.

Investment Recovery Strategies

All these tactics are unified by the one principle of Investment Recovery—the management of excess assets for maximum return.

Small businesses can no longer afford to let stock sit idle. By applying Investment Recovery strategies, you are able to:

- Free frozen working capital

- Decrease waste and storage costs

- Increase asset life

- Enhance corporate social responsibility

- Maximize ROI on Investment made

Recovery isn’t a problem solver but rather a smart business discipline that Investment Recovery Framework turns into a powerful opportunity.

Final Thoughts

Extra stock doesn’t have to be a problem. Small businesses can turn it into profit with the right steps. Start by picking just one of the 11 smart strategies and see how it works. Over time, you can try more of the ideas to improve how you manage unsold stock and make more money. Focus on making the most of what you already have, instead of always buying new things.