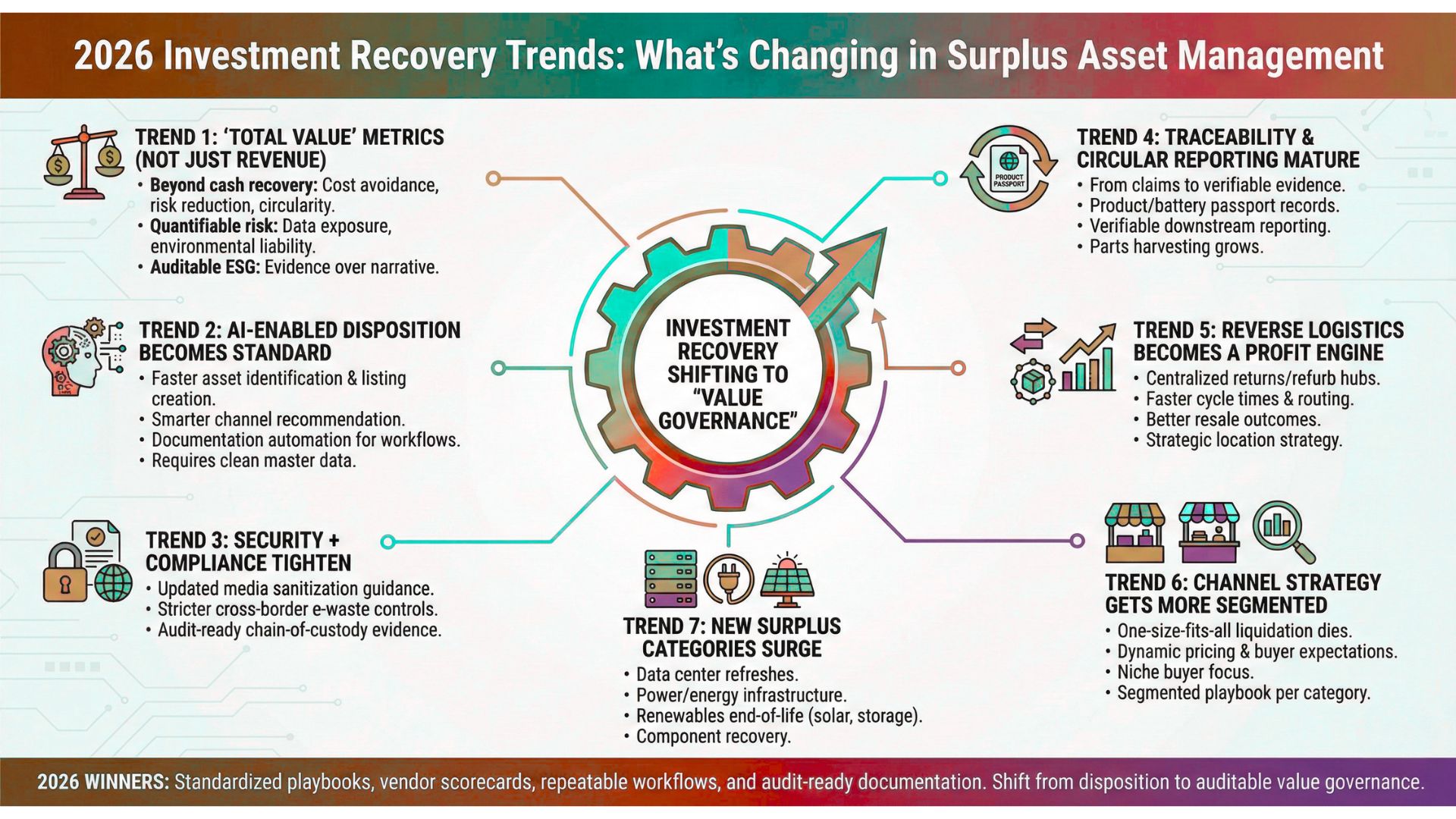

2026 Investment Recovery Trends: What’s Changing in Surplus Asset Management

For investment recovery (IR), surplus asset, procurement, operations, IT, EHS, finance, and sustainability leaders who need auditable value recovery – not just “getting rid of stuff.”

TL;DR

- IR is shifting from “disposition” to “value governance”: leadership wants documented outcomes—cash recovered, cost avoided, risk reduced, and circularity metrics.

- AI is moving from experiments to workflows: faster asset identification, better listings, smarter channel selection, and improved buyer matching—if your data is clean.

- Compliance got tighter: updated media sanitization guidance, stricter cross-border e-waste controls, and higher expectations for chain-of-custody evidence.

- Traceability is becoming a requirement: product/battery/passport-style records and verifiable downstream reporting are creeping into more categories.

- Reverse logistics is now a revenue strategy: centralized returns/refurb hubs, faster cycle times, and better resale outcomes beat “ship it to auction and hope.”

- Hot surplus streams in 2026: data center refreshes, power/energy infrastructure, renewables end-of-life, and parts harvesting.

- Winners in 2026 look boring (in a good way): standardized playbooks, vendor scorecards, repeatable pricing logic, and audit-ready documentation.

Why 2026 feels different

The best IR programs have always done more than sell surplus—they’ve protected the business. What’s changing in 2026 is the

expectation of proof: stakeholders want faster cycle times, tighter risk control, and measurable sustainability outcomes

alongside revenue.

At the same time, AI-driven productivity is becoming unavoidable. The bar is rising for how quickly teams can identify assets,

prepare buyer-ready listings, route items into the right channel, and document the downstream outcome. If your program relies

on tribal knowledge and spreadsheets that only one person understands, 2026 will expose it.

Related IRA reads:

Trend 1: “Total Value” metrics replace “how much did we sell?”

In 2026, the strongest IR teams are expanding scorecards beyond recovery revenue. Leadership increasingly cares about

total value—a blend of financial return, risk reduction, operational efficiency, and sustainability impact.

What’s changing

- Cost avoidance becomes first-class: redeploy/reuse wins, avoided storage, avoided disposal, avoided procurement.

- Risk becomes quantifiable: data exposure avoided, environmental liability reduced, contract compliance documented.

- Cycle time becomes strategic: aging inventory kills price, increases handling costs, and creates audit pain.

- ESG moves from narrative to evidence: auditable downstream outcomes and credible reporting matter more than “diverted from landfill” claims.

2026 KPI set

- Net recovery ($) by asset class and channel

- Cost avoidance ($) from redeploy/reuse/repair

- Disposition cycle time (days) from “declared surplus” → “closed outcome”

- Disposition compliance rate (required docs completed on time)

- Reuse/refurbishment rate (%) before recycle/disposal

- Chain-of-custody completeness (%) for regulated/high-risk categories

- Downstream reporting completeness (%) with vendor-verified outcomes

Additional resources:

If you’re building executive alignment around these metrics, start with

Asset Recovery Services: How to Maximize Returns from End-of-Life Equipment.

Trend 2: AI-enabled disposition becomes standard operating procedure

2026 is the year AI stops being a “cool side project” and becomes a baseline expectation.

But the teams who win aren’t the ones generating flashy demos—they’re the ones shipping reliable workflows.

Where AI is actually paying off

- Asset identification at scale: normalize messy descriptions, map SKUs, detect duplicates, build clean lots.

- Buyer-ready listings: consistent specs, condition grading, keywords, compliant disclaimers, and better photos.

- Channel recommendation: route to redeploy, direct sale, marketplace, broker, auction, scrap, or recycle based on rules + market signals.

- Faster sourcing: identify niche buyers and rebuild dormant buyer lists by category.

- Documentation automation: checklists, manifests, certificates, and audit packets built consistently.

The catch: AI magnifies your data quality

If your inventory fields are incomplete, inconsistent, or stale, AI won’t save you—it will simply automate bad decisions faster.

The best programs in 2026 treat master data cleanup and taxonomy as “value recovery infrastructure.”

Additional resources (highly relevant):

Trend 3: Security + compliance tighten (and the documentation burden rises)

Surplus asset management is increasingly judged by the quality of its controls—especially for IT assets, devices, and any category

with data, safety, or hazardous-material risk.

What’s changing in 2026

- Updated media sanitization guidance raises expectations for how organizations define, execute, and verify sanitization.

This impacts ITAD SOPs, vendor requirements, and audit packets. - Cross-border e-waste controls are stricter:

more e-waste movements require prior informed consent-style documentation, increasing the need for classification discipline and downstream controls. - Audit-ready chain of custody becomes table stakes:

who touched the asset, when, where it went, what happened to it, and proof of outcome.

What to do now

- Update your sanitization and disposition SOPs (and make vendors confirm alignment in writing).

- Strengthen vendor onboarding: certification expectations, insurance, downstream transparency, reporting cadence, breach notification.

- Standardize your “disposition packet” per asset class: inventory, photos, serials, transport docs, certificates, downstream reports.

- Create a “high-risk routing” rule set (regulated categories and data-bearing devices never go into generic liquidation channels).

Additional resources:

For a practical baseline on ITAD controls, see

E-Waste & ITAD Trends: A Playbook for IR Professionals.

Trend 4: Traceability and circular reporting mature (from “claims” to “evidence”)

2026 pushes more organizations toward verifiable “resource inflow/outflow” thinking: what materials came in, what went out,

what was reused, what was recycled, and what proof exists. For IR teams, this is both pressure and opportunity.

What’s changing

- Product-level traceability increases: more categories are moving toward passport-style records and data exchange expectations.

- Downstream transparency matters more: you may need recycler-level detail (not just “recycled”) for internal reporting and customer requirements.

- Parts harvesting and remanufacturing grow: teams increasingly justify labor because recovered components beat new procurement lead times and costs.

How IR teams can lead

- Define a reporting standard with vendors (fields, frequency, evidence).

- Build a category-based hierarchy: redeploy → refurb → resale → parts harvest → recycle → compliant disposal.

- Make “proof of outcome” contractual for strategic streams (IT, renewables, regulated materials).

Additional resources (build your circular playbook):

Trend 5: Reverse logistics becomes a profit engine (not an afterthought)

Whether you manage industrial spares, retail returns, IT refresh cycles, or leased equipment, the same pattern is showing up:

centralized inspection + faster routing decisions + refurbishment capability can materially improve value recovery.

What’s changing in 2026

- Central return hubs and standardized grading reduce the “mystery inventory” problem.

- AI-assisted routing speeds decisions: repair vs. redeploy vs. resale vs. recycle.

- Transport costs stay painful, making location strategy, consolidation, and lot building more important than ever.

What to do now

- Design your inspection + grading workflow (even a lightweight one) so you stop selling unknown-condition lots.

- Build a “fast lane” for high-demand items so good assets don’t decay in the warehouse.

- Engineer packaging + shipping rules for fragile/high-value categories to reduce damage and claims.

- Track the real cost-to-recover (labor + freight + fees) to route assets into profitable channels.

Trend 6: Channel strategy gets more segmented (one-size-fits-all liquidation dies)

“Sell everything through the same channel” leaves money on the table in 2026. The best programs use a segmented playbook:

certain categories do best with direct buyers, others with marketplaces, others via broker networks, and some only via compliant recycling.

What’s changing

- Pricing becomes more dynamic: the delta between “clean listing + right channel” and “generic lot dump” grows.

- Buyer expectations rise: better photos, consistent specs, serial capture, and clear terms reduce friction and improve recovery.

- Category specialization increases: niche buyers pay more when lots are curated and documented.

Practical channel playbook (starter)

- Redeploy first (internal transfer) for items with remaining useful life.

- Direct-to-buyer for specialized industrial equipment, spares, and high-value IT lots with complete documentation.

- Marketplaces/auctions for broad-demand categories where speed matters.

- Broker networks when your team lacks category expertise or needs global reach.

- Certified recycling for regulated, hazardous, or data-bearing categories with strict documentation requirements.

Additional resources:

For ROI-focused liquidation tactics, see

Equipment Liquidation: How to Maximize ROI When Selling Industrial Assets.

Trend 7: New surplus categories surge (data centers, power, renewables, parts harvesting)

2026 is producing “surplus waves” driven by modernization cycles: AI infrastructure upgrades, energy/power constraints,

and renewable equipment reaching new phases of reuse and end-of-life planning.

Where IR teams are seeing growth

- Data center refreshes (servers, storage, networking, racks, cooling components, power gear).

- Energy infrastructure and power-ready equipment (electrical gear, backup systems, industrial power components).

- Renewables end-of-life (solar modules, inverters, storage—plus parts harvesting strategies).

- High-value component recovery (reuse/reman of parts to reduce lead times and procurement costs).

Additional resources (highly relevant):

2026 Readiness Checklist

Governance

- Define a cross-functional IR “value council” (Finance + Supply Chain + IT + EHS + Security + Ops).

- Standardize approval thresholds and routing rules (especially for high-risk categories).

- Adopt a Total Value scorecard (recovery + avoidance + risk + cycle time + circular outcomes).

Process + data

- Implement a consistent asset taxonomy (category, condition, completeness, location, restrictions).

- Require minimum listing standards (specs + photos + condition grade + serial capture where applicable).

- Create category playbooks (channel, pricing logic, packaging, shipping, documentation).

Compliance + audit

- Refresh media sanitization requirements and verification steps for data-bearing assets.

- Strengthen chain-of-custody documentation templates and retention policy.

- Vendor contracts include downstream reporting requirements and breach notification timelines.

AI adoption (do this safely)

- Pick 2–3 high-impact workflows to automate (listing creation, buyer sourcing, routing recommendations).

- Use human-in-the-loop approvals for pricing, routing, and compliance decisions.

- Implement “AI guardrails” (no sensitive data in prompts, logging, prompt libraries, review checklists).

Want more IRA resources? Browse the

IR Articles & Blog library

for category-specific playbooks and case-driven guidance.

Summary

2026 is a “professionalization year” for surplus asset management. The winners will look less like heroic firefighters and more like

operators with repeatable systems: clean data, segmented playbooks, AI-enabled workflows, and audit-ready documentation.

If you build those foundations, you’ll recover more cash, avoid more cost, reduce more risk, and produce better sustainability outcomes—without burning out your team.

FAQs

What is the biggest investment recovery trend in 2026?

The biggest shift is moving from “sell surplus” to govern value: redeploy first, route assets with rules, document outcomes,

and report Total Value (revenue + avoidance + risk + circularity), supported by repeatable workflows.

How should IR teams use AI in 2026 without increasing risk?

Start with workflow automation that improves consistency (inventory cleanup, listing drafts, buyer research, routing recommendations),

keep humans in the approval loop, and adopt clear guardrails (no sensitive data in prompts, logging, and a standard review checklist).

Why is compliance getting harder for IT and electronics?

Expectations for sanitization verification, chain of custody, and cross-border movement documentation are rising. That means

stronger SOPs, better vendor requirements, and more complete audit packets for every load.

What surplus categories are “hot” in 2026?

Data center refresh equipment (AI-driven upgrades), power/energy infrastructure, renewables end-of-life (solar/storage),

and component harvesting/remanufacturing opportunities are all growing streams.

How do I convince leadership to invest in an IR program?

Build a business case around Total Value: net recovery, cost avoidance (redeploy/reuse), reduced storage and handling, reduced risk exposure,

improved compliance posture, and measurable circular outcomes. Then propose a phased roadmap with quick wins and governance upgrades.

Start here: How to Build an IR Business Plan That Works.