Sustainable Asset Management: The 2025 Guide to ESG-Compliant Asset Lifecycle Management

Sustainable Asset Management: The 2025 Guide to ESG-Oriented Asset Lifecycle Practices

The Investment Recovery Association’s community often discusses how surplus and end-of-life assets may represent both opportunities and potential risks. In 2025, conversations around this balance are shaped by expectations related to environmental, social, and governance (ESG) considerations, evolving climate and circularity reporting requirements, stricter e-waste rules, data-privacy obligations, and “right-to-repair” initiatives. This guide provides general insights into recent developments and how investment recovery (IR) programs could approach asset lifecycle management with ESG in mind—from acquisition through disposition.

What’s new in 2025 (and why IR teams may be paying attention)

-

Global ESG baseline reporting

The International Sustainability Standards Board (ISSB) has released IFRS S1 (general sustainability) and IFRS S2 (climate) standards, effective for reporting periods beginning January 1, 2024. These align with the earlier TCFD framework and may influence 2025 reporting cycles. Even where not legally required, some investors and customers appear to be treating these as common reference points. -

EU Corporate Sustainability Reporting Directive (CSRD)

In July 2025, the EU introduced a “quick fix” adjustment to its European Sustainability Reporting Standards (ESRS). Although timelines may shift, expectations around scope, assurance, and data quality remain topics of discussion. Organizations involved in EU markets may be asked for more detailed lifecycle data. -

U.S. SEC climate rule

The U.S. Securities and Exchange Commission adopted climate disclosure rules in March 2024. In March 2025, however, the Commission voted to end its defense amid ongoing litigation, leaving enforcement uncertain. Despite this, some companies may continue aligning voluntarily with investor or state requirements. -

Circularity and product design regulations in the EU

-

Ecodesign for Sustainable Products Regulation (ESPR) entered into force in July 2024. Over time, Digital Product Passports (DPPs) and design-for-repair/reuse expectations could expand across product categories.

-

Waste Electrical and Electronic Equipment (WEEE) rules are under review. A July 2025 evaluation suggested gaps in collection and recovery, which may increase attention on reuse and recycling practices.

-

Basel Convention guidance continues to govern cross-border e-waste shipments. Updates clarify when used equipment is classified as waste, highlighting the need for accurate documentation.

-

-

Right-to-repair developments

The EU adopted a Right-to-Repair Directive in 2024, with member-state application beginning mid-2026. Several U.S. states (including New York, California, and Minnesota) have enacted electronics repair laws. Repairability provisions may become a factor in how stakeholders evaluate ESG performance. -

Battery regulation

The EU Battery Regulation (2023/1542) is phasing in carbon-footprint declarations and digital “battery passports” (QR-linked lifecycle data). These requirements, beginning in 2025 for certain categories, suggest a growing emphasis on traceability.

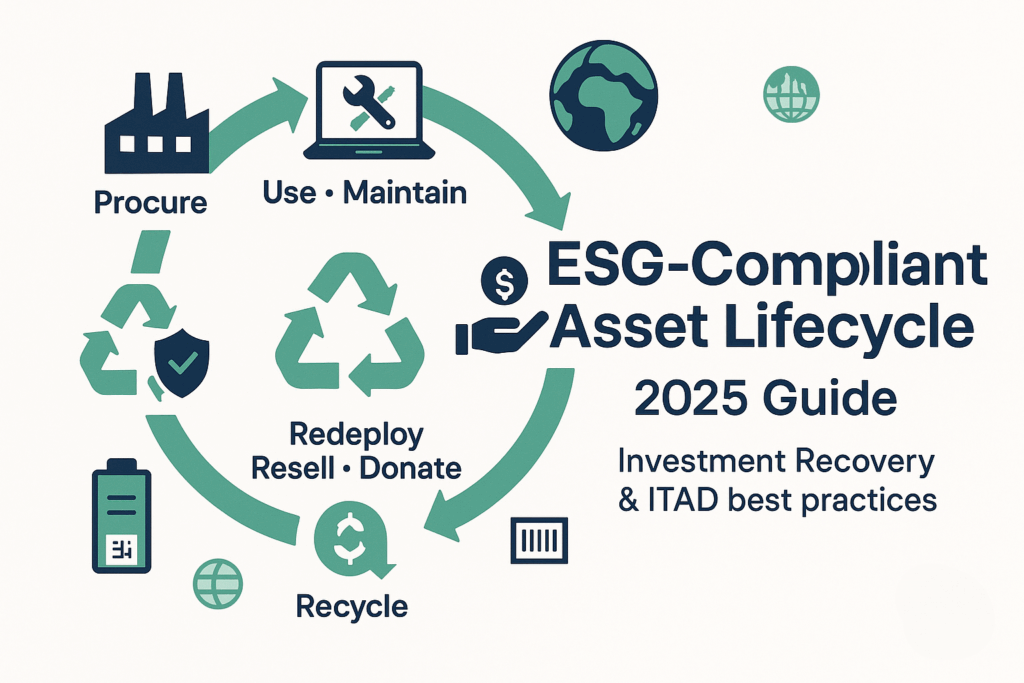

A lifecycle view of assets (buy → use → redeploy → sell/donate → recycle)

The following framework reflects commonly discussed practices that may support ESG-oriented asset lifecycle approaches. Organizations should assess relevance to their own context.

Plan & Procure

Consider contract language that anticipates end-of-life, such as provisions for repair, parts, or disposal.

Track assets with serialization to support chain-of-custody records.

Operate & Maintain

Preventive maintenance and upgrades may help extend useful life.

Documenting repair versus replacement decisions may provide useful context for ESG reporting.

Identify Surplus

Establish criteria for redeploying, refurbishing, reselling, donating, or recycling equipment.

Data Protection by Design

Reference widely used standards such as NIST SP 800-88 Rev.1 for media sanitization.

Organizations handling personal data in the EU/UK should review GDPR and ICO guidance regarding secure destruction.

Disposition & Logistics

Some organizations choose certified partners such as R2v3 or e-Stewards, which include verification requirements.

For international shipments, documentation aligned with Basel technical guidelines may help reduce compliance risks.

Value Recovery

Options for resale, donation, or recycling may vary depending on compliance requirements and organizational objectives.

What to measure (for reporting purposes)

Organizations may find it useful to track indicators that can be linked to ESG frameworks such as the Greenhouse Gas (GHG) Protocol’s Scope 3 categories. Examples often include:

-

Diversion rate (e.g., % by weight diverted from landfill/incineration).

-

Reuse rate (e.g., % redeployed or resold).

-

Revenue or proceeds from disposition activities.

-

Data sanitization compliance (e.g., % of devices with certificates).

-

Paperwork accuracy for cross-border shipments.

Compliance considerations in 2025

-

Policies & controls: Maintain written asset lifecycle policies, review vendor practices, and consider alignment with standards like NIST 800-88.

-

Vendors & logistics: Confirm partner certifications, conduct due diligence, and prepare for Basel-related requirements if shipping across borders.

-

Reporting & evidence: Establish registers and KPI tracking that can integrate with ISSB or CSRD reporting where relevant.

-

EU-specific watch-outs: Stay updated on ESPR, DPP, and battery-related timelines.

Partnering with sustainability teams

Possible approaches for IR and sustainability collaboration may include:

-

Standardizing disposition data across vendors.

-

Publishing a clear reuse hierarchy (redeploy → resale → donation → recycling).

-

Aligning metrics with disclosure categories to simplify integration.

-

Running regular “asset harvest” reviews to surface underutilized stockpiles.

-

Piloting repair programs to evaluate potential benefits.

IT assets, data, and certifications

-

Sanitization: NIST SP 800-88 Rev.1 describes Clear, Purge, and Destroy methods, with verification.

-

Certifications: R2v3 and e-Stewards provide frameworks for downstream vendor controls and environmental practices.

-

Privacy alignment: UK ICO and GDPR guidance emphasize policies and proof of secure data destruction.

A suggested 90-day playbook (informational example only)

-

Review past disposition records to establish a baseline.

-

Address missing certificates or gaps by working with certified vendors.

-

Refresh intake forms to include emerging requirements (e.g., repairability, DPP readiness, battery data).

-

Establish periodic reviews between IR and sustainability teams.

-

Pilot redeployment workflows to collect insights into cost and emissions implications.

Disclaimer

This content is provided for informational purposes only and does not constitute professional, legal, financial, or compliance advice. Organizations should consult qualified advisors when making decisions related to ESG reporting, regulatory compliance, or asset lifecycle management.