How to Create an Investment Recovery Department: Organizational Models That Scale

How to Create an Investment Recovery Department: Organizational Models That Scale

Turning idle, obsolete, and end-of-life assets into measurable cash recovery, cost avoidance, and compliance certainty starts with one decision: how you organize the function.

TL;DR

- Pick a model (Centralized, Decentralized, Hybrid/Federated, Center of Excellence, Shared Services, or Outsourced) based on asset volume, risk, geography, and speed requirements.

- Design the operating system: a clear charter, intake & approval workflow, chain-of-custody, vendor governance, pricing/valuation rules, and reporting cadence.

- Staff the “minimum viable department”: IR leader + disposition specialist + compliance/data-sanitization owner + analyst (or shared resources).

- Measure like Finance: recovery value, cost avoidance, cycle time, redeployment rate, compliance exceptions, and sustainability diversion.

- Use the IRA ecosystem to accelerate: download the Member Service Directory, train via the IR Learning & Resource Center (LMS), and benchmark with peers.

Table of Contents

- What an Investment Recovery Department Actually Does

- Why the Organizational Model Matters

- The 6 Core Organizational Models (with best-fit guidance)

- How to Choose the Right Model (Decision Matrix)

- Step-by-Step Blueprint to Build the Department

- Roles, Staffing Levels, and Org Charts

- Governance, Controls, and Compliance (ITAD + environmental)

- KPIs and Reporting Cadence

- Tools and Systems (from spreadsheets to platforms)

- 30–60–90 Day Launch Plan

- Templates: Charter, RACI, Policy Outline, Vendor Scorecard

- FAQs

What an Investment Recovery Department Actually Does

An Investment Recovery (IR) department is the cross-functional capability responsible for reclaiming value from surplus, idle, retired, or end-of-life assets through redeployment, refurbishment, resale, return, recycling, or compliant disposal.

Done right, IR is not “selling scrap.” It’s a disciplined asset disposition program that coordinates Finance, Supply Chain, Operations, IT, EHS, Legal, and Security to turn stranded value into audited outcomes.

If you’re new to the discipline, start with the Ultimate Guide to Investment Recovery, then read

Asset Disposition Explained for the process view (identification → evaluation → segregation → disposition → documentation).

Core responsibilities (regardless of model)

- Asset identification & intake: catch surplus early, before it depreciates in a yard or warehouse.

- Valuation & disposition planning: determine best path (redeploy vs. sell vs. recycle) based on economics and risk.

- Channel strategy: select the right route to market (auctions, direct buyers, brokers, OEM takeback, ITAD, scrap, donation).

- Compliance & documentation: chain-of-custody, approvals, data sanitization, regulated waste handling, export controls, brand risk.

- Performance management: KPIs, dashboards, and continuous improvement cycles.

Invrecovery perspective: modern IR has expanded beyond recycling and surplus sales into regulatory compliance, circular economy methods, environmental stewardship, and ROI maximization. (This is exactly why organizational design matters.)

Why the Organizational Model Matters

Two companies can run the same auctions, use the same vendors, and still produce radically different outcomes. The difference is usually not “effort.” It’s structure:

who owns decisions, how approvals work, where data lives, and whether local teams can move fast without violating policy.

What changes when you change the model

- Speed: time from “declared surplus” to “disposition complete.”

- Control & consistency: standardized pricing, contracts, and compliance evidence.

- Leverage: aggregated volume means better buyer demand, better vendor terms, and clearer forecasting.

- Adoption: whether business units actually use the program (or go around it).

- Risk posture: data-bearing assets, hazardous materials, controlled tech, and brand exposure require stricter control.

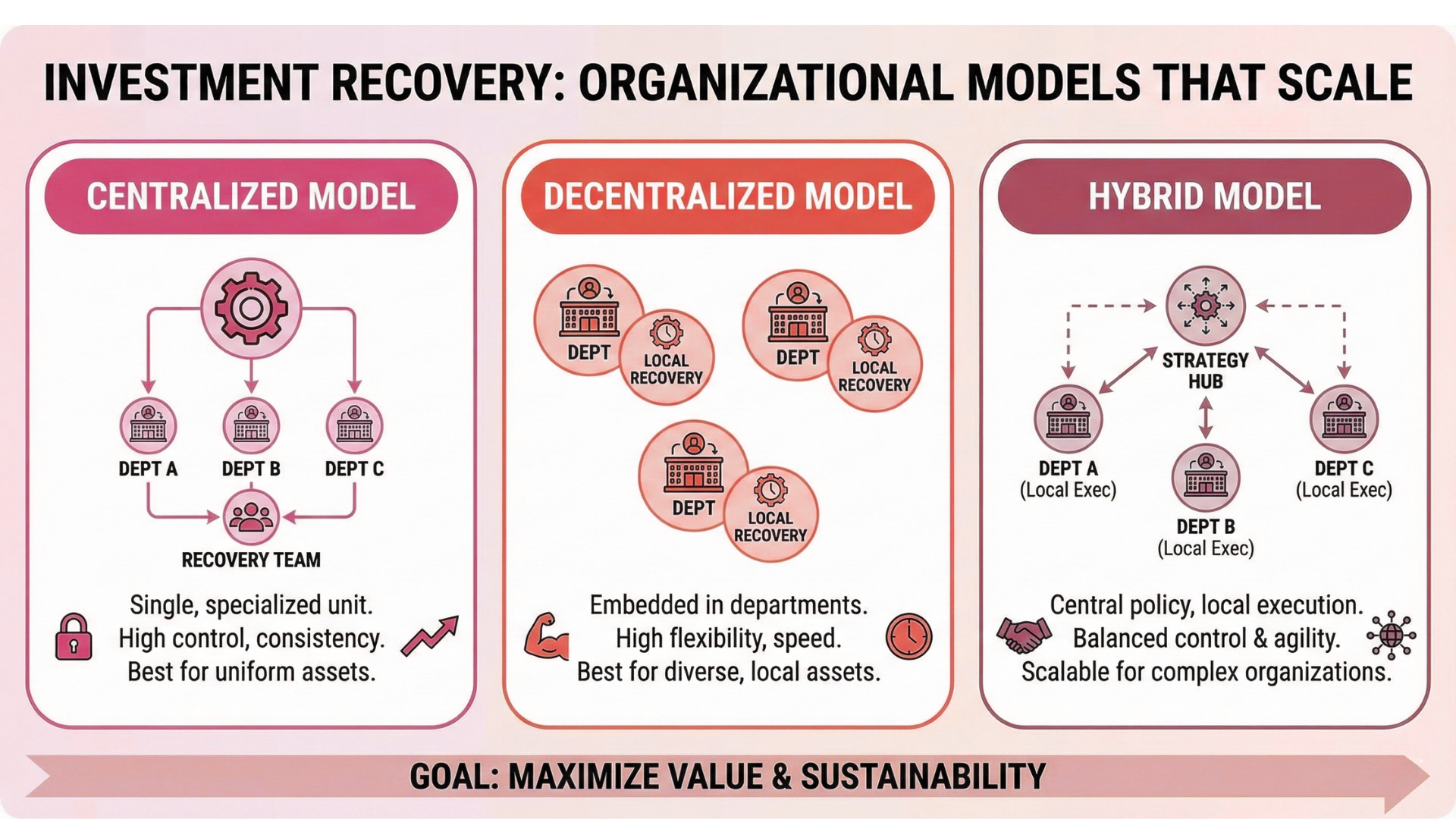

The 6 Core Organizational Models (with best-fit guidance)

1) Centralized IR Department (Corporate-owned)

A single corporate IR team owns policy, approvals, disposition strategy, and often execution. Local sites feed assets into a standard pipeline.

Best for: high volumes, high compliance risk (ITAD/regulated), strong need for standardization, or highly matrixed enterprises that want one source of truth.

Strengths:

- Maximum consistency in controls, contracts, and reporting

- Stronger negotiating power with buyers and service providers

- Cleaner audit trail (especially for data, EHS, and export controls)

Tradeoffs:

- Can feel “slow” if the central team becomes a bottleneck

- Requires strong intake discipline and clear SLAs with sites

Example org chart (centralized)

- VP Supply Chain / CFO Sponsor

- Director, Investment Recovery

- IR Operations

- Disposition Specialists (by asset class: IT, MRO, vehicles, heavy equipment, real estate/closures)

- Vendor & Contract Manager

- Compliance / Data Sanitization Lead

- IR Analyst (pricing, KPIs, forecasting)

- Site Liaisons (dotted line): Operations / Maintenance / IT

2) Decentralized IR (Business-unit or site-owned)

Each business unit or site manages its own recovery activities. Corporate may provide light guidance, but execution is local.

Best for: highly diverse operations (different markets/regulations), fast-moving sites, or organizations where local leaders already have strong buyer networks and autonomy.

Strengths:

- Fast decisions and local responsiveness

- Deep knowledge of local market demand and logistics realities

Tradeoffs:

- Inconsistent compliance and documentation

- Fragmented pricing, contracts, and vendor quality

- Harder to benchmark and improve enterprise-wide

Watch-out: decentralized models are most vulnerable on data-bearing assets and regulated waste streams unless minimum controls are mandatory.

3) Hybrid / Federated Model (Central governance + local execution)

Corporate defines policy, approved vendors, templates, KPIs, and systems. Local teams execute day-to-day disposition inside that framework.

Best for: medium-to-large organizations that want both control and speed; multi-site enterprises where “one size fits all” is unrealistic.

Strengths:

- Standardization where it matters (policy, contracts, audit evidence)

- Local agility for logistics, timing, and operational coordination

Tradeoffs:

- Requires tight governance design (RACI + SLAs) to prevent confusion

- Needs a shared system of record, not “site spreadsheets forever”

Hybrid “rules of the road” (simple and effective)

- Corporate owns: policy, risk thresholds, vendor approvals, contract templates, KPI definitions, audit readiness.

- Sites own: identification, staging, asset condition info, local logistics, executing approved disposition paths.

- Shared: pricing guidance, buyer qualification, chain-of-custody, and revenue recognition workflow with Finance.

4) Center of Excellence (CoE) + Shared Playbooks

A lean expert team (CoE) designs standards, training, tooling, and governance. Execution remains in BUs/sites, but the CoE drives maturity, vendor strategy, and optimization.

Best for: organizations that can’t (or won’t) centralize execution, but still want enterprise standards, training, and performance improvement.

Strengths:

- Lower headcount than full centralization

- Strong capability-building (training, templates, audits, buyer-ready listing standards)

- Scales well when paired with IRA learning resources

Tradeoffs:

- Success depends on BU leaders actually adopting standards

- Harder to force compliance without executive mandate

To accelerate capability-building, point teams to the IR Learning & Resource Center (LMS) and consider professional development via

CMIR certification.

5) Shared Services Model (Procurement/Finance-led service)

IR is delivered as a shared service inside Procurement, Supply Chain, Finance, or Corporate Services. It often works like an internal agency: published service catalog, SLAs, and chargeback rules if needed.

Best for: enterprises that already run shared services (AP, sourcing, travel, facilities) and want predictable service delivery.

Strengths:

- Clear service levels and internal customer experience

- Easy to standardize reporting, revenue routing, and controls

Tradeoffs:

- If positioned incorrectly, can be viewed as “administrative” instead of value creation

- Needs strong stakeholder engagement to avoid shadow disposition

6) Outsourced / Managed IR (with internal governance)

A third party runs execution (and sometimes tooling), while your organization retains governance: policy, approvals, risk rules, and audit ownership.

Best for: organizations with limited internal bandwidth, fast ramp needs, or specialized asset classes (e.g., ITAD, heavy equipment, closures/decommissioning).

Strengths:

- Fast start and access to existing channels, buyers, and logistics

- Useful when asset classes require specialized expertise

Tradeoffs:

- You still need internal ownership of controls, approvals, and risk

- Without KPIs and evidence requirements, “outsourced” can become “out of sight”

If you’re looking for vetted service partners across categories, start with the

2026 Investment Recovery Member Service Directory.

How to Choose the Right Model (Decision Matrix)

| Decision factor | If this is true… | Lean toward… |

|---|---|---|

| High data/security risk (servers, laptops, drives) | You must prove sanitization + chain-of-custody | Centralized, Hybrid, or CoE + strict controls |

| Many sites / geographies | Local logistics and regulations vary widely | Hybrid/Federated or CoE |

| Large recoverable volume | You need leverage with buyers and vendors | Centralized or Shared Services |

| Low internal capacity | You need a fast ramp without hiring | Outsourced (with strong governance) |

| Culture of BU autonomy | Corporate mandates are hard to enforce | CoE + playbooks, or Hybrid with light-touch controls |

A simple rule that works in the real world

- Centralize governance when risk is high (data, regulated materials, export controls, brand).

- Localize execution when speed and logistics are the constraint.

- Standardize the evidence (what you must prove) even if execution varies.

Step-by-Step Blueprint to Build the Department

Step 1: Write the IR charter (one page)

Your charter should answer:

- Scope: which asset classes (IT, MRO, fleet, furniture, inventory, heavy equipment, facilities/closures).

- Value goals: revenue recovery + cost avoidance + risk reduction.

- Authority: who can declare surplus, approve disposition, and sign buyer/vendor agreements.

- Non-negotiables: data sanitization rules, chain-of-custody, environmental compliance, and documentation retention.

Step 2: Choose your model and publish a “how we work” guide

Don’t just name the model—define the operating rules: what is centralized, what is local, and what must be documented every time.

Step 3: Map the end-to-end process

Use the same stages across asset classes (even if the details differ):

- Identify (triggers: projects, refresh cycles, shutdowns, excess inventory, warranty returns)

- Intake (asset data captured, photos, condition, serials, location, ownership/cost center)

- Evaluate (redeploy vs. sell vs. recycle; risk classification)

- Approve (RACI-based approval gates)

- Execute (staging, listings, buyer qualification, pickup/shipping)

- Close (financial closeout + compliance evidence + lessons learned)

For deeper process guidance, reference Asset Disposition Explained.

Step 4: Define disposition pathways by asset class

- Redeploy: internal transfer marketplace, inter-site transfers, spares optimization

- Resell: auctions, direct sale, brokered sale, remarketing, OEM channels

- Return: warranty return, vendor return, leasing return

- Recycle/Dispose: certified recyclers, hazardous waste pathways, documented destruction

Step 5: Build your vendor strategy

Create an approved vendor list by category (ITAD, auctioneers, scrap/metals, environmental & demolition, appraisals, logistics).

If you need a starting point, use the Member Service Directory to shortlist by service type.

Step 6: Establish controls that protect the organization

- Chain-of-custody: who had it, when, and where it went

- Buyer qualification: sanctions/export screening as required, resale restrictions, “as-is” terms

- Data sanitization: clear decision rules for wipe vs. purge vs. destroy

- Environmental compliance: documentation of downstream processing and certificates where relevant

- Brand protection: de-branding rules, serialization, and “no internal data” evidence

Step 7: Stand up the “system of record”

Start simple, but avoid the trap of 15 spreadsheets that can’t be audited. Your system must track:

asset attributes, approvals, disposition path, vendor/buyer, dates, proceeds/costs, and compliance artifacts.

Step 8: Launch with a focused pilot

Pick one site and one asset category where recoverable value is obvious (e.g., IT refresh, MRO surplus, or facility consolidation).

Prove results fast, then expand.

Step 9: Build the business case for scale

If you need help framing the program for executives, use

How to Build an Investment Recovery Business Plan That Works.

Roles, Staffing Levels, and Org Charts

Minimum Viable IR Department (works for many organizations)

- IR Lead (Manager/Director): owns charter, governance, stakeholder alignment, performance

- Disposition Specialist: runs sales channels, buyer/vendor coordination, listings, pricing

- Compliance & Data Owner: data sanitization evidence, chain-of-custody, EHS alignment

- Analyst (part-time or shared): KPI dashboards, forecasting, inventory aging, root causes

Scaling roles (as volume and risk increase)

- Category leads: ITAD, heavy equipment, metals/scrap, inventory, facilities/closures

- Vendor manager: scorecards, audits, contract performance, downstream assurance

- Marketplace coordinator: internal redeployment marketplace and inter-site matching

- Project IR lead: decommissioning, shutdowns, relocations (time-bound surges)

Where IR typically reports

- Supply Chain / Procurement: best when IR is integrated with sourcing, contracts, and logistics

- Finance: best when governance, fixed-asset accounting, and auditability are primary

- Operations: best when asset-heavy facilities drive most surplus (plants, utilities, energy)

- Sustainability/EHS (less common): best when circularity and waste diversion are primary goals (but ensure financial rigor remains strong)

Governance, Controls, and Compliance (ITAD + Environmental)

Data-bearing assets: define sanitization rules and evidence

For IT assets, your IR model must specify who owns the sanitization decision, who performs it, and what proof is retained.

Many organizations align their approach to recognized guidance such as NIST SP 800-88 (media sanitization decision-making).

Electronics recycling / ITAD: require credible certifications where appropriate

If your program touches electronics reuse and recycling, consider requiring vendor certifications that reflect data security, environmental, and worker safety controls (for example, frameworks such as R2 and e-Stewards are commonly referenced in the ITAD ecosystem).

Governance artifacts that prevent chaos (and make audits survivable)

- RACI matrix: who is Responsible, Accountable, Consulted, Informed

- Approval thresholds: by asset value, asset class, and risk category

- Documentation retention: chain-of-custody, certificates, buyer records, and transaction files

- Exception process: how you handle urgent disposals or nonstandard pathways

For organizations formalizing IT asset governance, recognized frameworks such as ISO/IEC 19770-1 (IT asset management systems) can help structure the management system around policies, controls, and continuous improvement.

KPIs and Reporting Cadence

Executive KPIs (quarterly)

- Recovered value: gross proceeds from resale + rebates + credits

- Cost avoidance: redeployment savings, avoided storage, avoided disposal costs

- Cycle time: average days from surplus declaration → disposition complete

- Compliance: exceptions, missing evidence, audit findings (target: trending down)

- Sustainability: diversion rate, reuse/refurbish %, landfill avoidance

Operator KPIs (monthly)

- Aging inventory: assets stuck in staging > 30/60/90 days

- Recovery rate: proceeds vs. fair market estimate (by asset class)

- Channel effectiveness: auction vs. direct sale vs. broker vs. OEM returns

- Vendor performance: pickup SLAs, settlement accuracy, documentation completeness

Pro tip: publish a one-page “IR scorecard” every month. If stakeholders see consistent results, adoption rises—and shadow disposition falls.

Tools and Systems (from spreadsheets to platforms)

Level 1 (starter): controlled spreadsheets + shared drive evidence

- Standard intake form + asset register

- Defined folder structure for evidence (by asset ID)

- Monthly scorecard in a shared dashboard

Level 2 (scalable): workflow + inventory + marketplace

- Request/intake workflow with approvals

- Asset database with photos/serials

- Internal redeployment marketplace (even if simple)

- Vendor portal for pickups, settlements, certificates

Level 3 (enterprise): integrated governance + analytics

- ERP/CMMS/ITAM integrations

- Automated asset identification triggers

- Analytics by site, category, channel, and vendor

- Audit-ready evidence capture and retention

For technology-driven improvements, see 9 Tech-Driven Strategies to Boost Your Surplus Asset Recovery.

30–60–90 Day Launch Plan

Days 1–30: Define and align

- Confirm sponsor (CFO/Supply Chain/Operations) and publish the IR charter

- Select operating model (start with Hybrid if uncertain)

- Map the process and define approval gates

- Identify top 2 asset classes for pilot (highest value + fastest cycle)

Days 31–60: Pilot execution

- Stand up intake workflow and evidence capture

- Shortlist vendors (use the Member Service Directory)

- Run 1–2 disposition cycles end-to-end

- Publish the first monthly IR scorecard

Days 61–90: Scale the program

- Expand to additional sites or asset classes

- Implement vendor scorecards and quarterly business reviews

- Formalize training plan via the IR Learning & Resource Center (LMS)

- Build the executive business case for headcount/tools as needed

Templates (copy/paste starters)

1) IR Charter (outline)

- Mission: recover value + reduce risk + support sustainability goals

- Scope: included asset classes and exclusions

- Authority: disposition approvals, contract authority, thresholds

- Controls: chain-of-custody, sanitization, environmental compliance

- KPIs: recovered value, cost avoidance, cycle time, compliance exceptions

- Cadence: monthly scorecard, quarterly steering committee

2) RACI (starter)

| Activity | IR Team | Site Ops | IT/Security | Finance | EHS/Legal |

|---|---|---|---|---|---|

| Declare asset surplus | C | R | C | C | C |

| Disposition plan selection | R/A | C | C | C | C |

| Data sanitization evidence (IT) | C | C | R/A | I | I |

| Revenue routing / asset retirement | C | I | I | R/A | C |

3) Vendor scorecard (starter categories)

- Pickup timeliness (SLA adherence)

- Settlement accuracy & transparency

- Documentation completeness (certificates, chain-of-custody)

- Downstream assurance (where material goes)

- Data security controls (for ITAD)

- Customer experience (communication, issue resolution)

FAQs

What’s the best organizational model for most companies?

If you’re unsure, start with a Hybrid/Federated model: central governance with local execution. It balances control, speed, and adoption.

Where should the IR department report (Finance vs Procurement vs Operations)?

Choose based on your primary constraint: Finance for auditability, Procurement for contracts/channel leverage, Operations for asset-heavy environments. Many mature programs use a hybrid governance council regardless of reporting line.

How many people do we need to start?

A “minimum viable” program can start with 1–2 dedicated owners plus shared support (Finance/IT/EHS). Scale staffing when volume and risk demand it.

How do we prevent business units from selling assets on their own?

Make the program easier than going around it: fast SLAs, clear rules, transparent results, and leadership mandate for controlled assets. Publish monthly scorecards to prove value.

What’s the biggest hidden risk in IR programs?

Data-bearing assets and weak chain-of-custody. If you can’t prove where an asset went and what happened to its data, you’re exposed—regardless of recovery value.

What’s the fastest way to improve recovery outcomes?

Improve early identification and reduce time-in-limbo. The longer assets sit, the more they depreciate, get damaged, or become noncompliant.

How do we find the right vendors?

Use IRA resources to shortlist by category, then run a structured evaluation with a scorecard and evidence requirements.

Start with the Member Service Directory.

How do we train internal teams?

Standardize training and playbooks, then reinforce them through onboarding and refreshers.

The IR Learning & Resource Center (LMS) and CMIR pathway can accelerate maturity.

Where can we connect with peers and learn best practices?

Explore the IRA webinars, read Asset 2.0 issues, and consider attending the

2026 Conference & Trade Show.

Next Steps

- Pick your model: Centralized, Decentralized, Hybrid, CoE, Shared Services, or Outsourced.

- Publish the charter: scope, authority, controls, and KPIs.

- Run a pilot: one site + one asset class, end-to-end.

- Scale with the IRA ecosystem: download the Member Service Directory and build capability through the IR Learning & Resource Center.