Healthcare Equipment Liquidation: Maximize Value from Medical Surplus

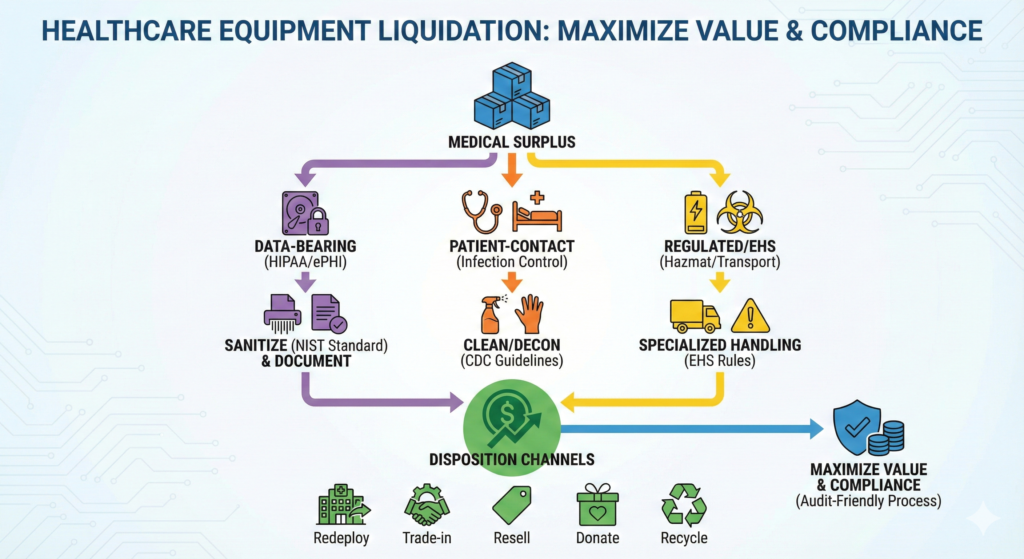

Healthcare surplus isn’t like “normal” surplus. A hospital bed might look like a simple asset – until you discover embedded storage, patient-contact contamination requirements, batteries regulated for transport, or service actions that could shift a device into “remanufacturing” territory.

This guide is written for Investment Recovery (IR) teams, supply chain, biomed, IT/security, and facilities leaders who need a repeatable, audit-friendly process to liquidate healthcare equipment while protecting patients, brand reputation, and enterprise compliance.

TL;DR

To maximize recovery on medical surplus:

- Segment early (data-bearing vs. patient-contact vs. regulated/hazardous) so you don’t “poison” high-value lots with compliance risk.

- Treat PHI/ePHI as a liquidation blocker until sanitized and documented -HIPAA requires reasonable safeguards during disposal, and covered entities must address the final disposition of ePHI and the hardware/media it sits on.

- Use NIST media sanitization guidance as the backbone for your data destruction standard and evidence package; note NIST SP 800-88 Rev. 1 was superseded by Rev. 2 in 2025.

- Build channel strategy around FDA-aware partners (service vs. remanufacture isn’t just semantics).

- Bake in EHS and transport rules (universal waste, batteries, mercury-containing components, shipping lithium batteries, sealed sources).

Why healthcare liquidation is uniquely complex

Most industries worry about value and logistics. Healthcare adds at least four more layers:

1) Patient data can live in surprising places

Beyond laptops and servers, PHI/ePHI often resides in:

- imaging workstations, ultrasound systems, patient monitors, anesthesia machines

- infusion pumps, lab analyzers, smart beds, nurse-call devices

- removable media, internal SSDs, USB ports, cached DICOM / HL7 exports

HIPAA’s disposal expectations apply to PHI “in any form,” and covered entities must apply reasonable safeguards to prevent impermissible disclosures.

2) Infection control is part of “asset readiness”

If a device had patient contact, you need a plan to ensure it can be safely handled, transported, and remarketed. CDC guidance emphasizes inspecting equipment integrity and ensuring items can be properly cleaned and disinfected/sterilized (or repaired/removed from use).

3) Device servicing vs. remanufacturing matters

If downstream partners modify equipment in ways that significantly change performance, safety specs, or intended use, FDA treats that as remanufacturing, which triggers different regulatory expectations than routine servicing/repair.

4) Environmental + transport rules can derail timelines

Medical surplus may include:

- universal waste categories (batteries, lamps, mercury-containing equipment, aerosol cans, etc.) under 40 CFR Part 273

- lithium batteries that are regulated hazardous materials for transportation under DOT HMR

- radiological/therapy-related items involving sealed sources and registry/handling considerations

The compliance-first liquidation framework

INV Recovery often frames disposition work as a repeatable, six-phase process (Identification → Evaluation → Segregation → Valuation → Disposition → Close-out & Reporting).

Below is the healthcare-specific version—built to protect value and reduce downstream risk.

Healthcare Equipment Liquidation: Maximize Value from Medical Surplus

Phase 1: Identification (make the inventory liquidation-ready)

Goal: Create a single source of truth that biomed, IT/security, EHS, finance, and vendors can all rely on.

Minimum data fields (recommended):

- Manufacturer, model, serial number, asset tag, UDI (if available)

- Condition (working/unknown/for parts), missing components/accessories

- Maintenance/service history and calibration status (if applicable)

- Patient-contact classification (yes/no/unknown)

- Data-bearing indicator (yes/no/unknown)

- Power type and batteries (including embedded batteries)

- Hazmat indicators (mercury components, lamps, etc.)

- Ownership status (owned/leased/rented), restrictions, liens

- Location, removal constraints (floor loading, elevators, door widths)

Healthcare pro move: Flag equipment into three immediate “lanes”:

- Data-bearing (requires sanitization evidence)

- Patient-contact (requires cleaning/decon workflow sign-off)

- Regulated/EHS (requires EHS + transport review)

Phase 2: Evaluation (triage compliance risk before you chase price)

Goal: Decide what can be sold, what must be serviced/refurbished, and what should be recycled—before marketing.

A. HIPAA/ePHI evaluation

HIPAA expects covered entities to apply safeguards in disposal, and the Security Rule includes requirements around device/media controls and final disposition of ePHI and the media/hardware it’s on.

Practical decision rule:

If there’s any credible chance the asset stores ePHI, treat it as “hold” until sanitization is complete and documented.

B. Infection control evaluation

Coordinate with infection prevention and biomed. If the item can’t be cleaned/disinfected/sterilized due to damaged surfaces or integrity issues, it may be unsuitable for reuse channels (and better routed to parts harvesting or recycling).

C. FDA/regulatory evaluation (partner readiness)

Your IR team usually isn’t “remanufacturing”- but your downstream partner might be. FDA distinguishes servicing from remanufacturing and regulates remanufacturing differently.

That means vendor qualification and contract language become value protection.

Phase 3: Segregation (the fastest way to protect both value and compliance)

Goal: Prevent cross-contamination—operationally and legally.

A simple, effective segregation map:

1) Data-bearing assets

- Hold in a controlled area

- Restrict access

- Track chain-of-custody from collection → sanitization → release

2) Patient-contact assets

- Route through cleaning/decontamination workflow aligned with internal policy and manufacturer instructions, supported by CDC best practices

- Document the outcome (pass/fail, date, responsible department)

3) EHS / regulated assets

- Universal waste stream management considerations (40 CFR Part 273)

- Batteries and transport requirements (DOT HMR)

- Sealed source/radiological oversight (NRC/Agreement State resources)

Why this increases ROI: Segregation lets you sell high-value items faster, while slower, higher-risk items move through compliance gates without holding the entire project hostage.

Phase 4: Valuation (healthcare-specific levers that move price)

Valuation in healthcare is less about “what it is” and more about “how ready it is” for a buyer.

Value levers that consistently matter

- Completeness: probes, carts, transducers, cables, modules, manuals

- Service records: maintenance history + calibration status

- Known-good condition: demonstrated power-on testing, error logs cleared (where appropriate)

- Compliance package: data sanitization certificate, decon attestation, chain-of-custody

- Removal logistics: de-install documentation, rigging requirements, timelines

Pro tip: Bundle as “buyer-ready lots.” A monitor without leads is scrap-adjacent; a complete, tested lot is resale-ready.

Phase 5: Disposition (specialized channels for healthcare surplus)

Here are the most common channels—and what to watch for.

1) Internal redeployment (highest value with lowest external risk)

Before liquidation, check internal demand across:

- sister facilities, outpatient expansions, simulation labs, training programs

This aligns well with IR’s “redeploy first” mindset on INV Recovery.

2) OEM trade-in / manufacturer programs

Often best for high-end modalities when:

- de-install is complex

- OEM service certification matters

- buyer trust depends on OEM-backed support

3) Qualified refurbishers / resellers (the main “specialized channel”)

Contract must define:

- responsibility for regulatory compliance (including servicing vs. remanufacturing distinctions)

- recall/field action checks (process + documentation)

- required documentation returned to you (COC, COI, sanitization proof, destination reporting)

4) Auctions (great for broad demand categories)

Auctions can perform well for:

- general medical/surgical equipment, furniture, non-invasive devices

But they need strong listing quality and strict lot controls (data-bearing items should not be mixed in unless sanitized and documented).

5) Donation (value is real – but not automatic)

Donation can support community health initiatives, but you still need:

- decontamination + condition disclosures

- data sanitization evidence

- documentation of transfer and recipient acceptance

6) Recycling / parts harvesting (the right answer for some assets)

When patient-contact integrity is compromised or market demand is weak, recycling can be the most defensible route—especially when universal waste and battery handling rules apply.

The HIPAA + data sanitization playbook (do this every time)

HHS makes clear that covered entities generally may not place PHI in dumpsters/recycling/trash accessible to the public unless it has been rendered unreadable/indecipherable and cannot be reconstructed, and it describes acceptable approaches for paper and electronic media.

Step 1: Determine whether your vendor is a Business Associate

HHS notes a covered entity may hire a business associate to dispose of PHI – but must have the appropriate agreement and safeguards in place.

Step 2: Use NIST as the sanitization standard

HHS explicitly points readers to NIST SP 800-88 for practical sanitization guidance.

Also note: NIST SP 800-88 Rev. 1 was superseded by Rev. 2 in 2025, so update policies if you still reference Rev. 1.

Step 3: Standardize your evidence package

NIST includes examples of a “Certificate of Sanitization” (useful as a template for your audit file).

A practical evidence packet often includes:

- asset list with serials

- method used (clear/purge/destroy)

- date/time and technician or system record

- exceptions log (failed drives, inaccessible storage) + remediation path

- chain-of-custody documents

EHS + transport checklist (the stuff that causes surprise delays)

Universal waste (40 CFR Part 273)

If your surplus includes batteries, lamps, mercury-containing components, or aerosol cans, make sure you’re managing them under an appropriate program and tracking rules for handlers and shipments.

Lithium batteries and shipping

DOT/PHMSA treats lithium batteries as hazardous materials under the Hazardous Materials Regulations, and they must meet applicable packaging/communication requirements when offered for transport.

Sealed sources / radiological considerations

For devices involving sealed sources, NRC resources (and Agreement State requirements) are central to understanding registration and handling expectations.

Close-out & reporting (where IR teams win trust)

Healthcare liquidation should end with an “audit file,” not a pile of invoices.

Close-out deliverables to standardize:

- Final asset disposition report (sold/redeployed/donated/recycled/destroyed)

- Chain-of-custody from pickup to final destination

- Data sanitization certificates (NIST-aligned)

- Recycling certificates / downstream vendor reporting (where applicable)

- Financial reconciliation: proceeds, fees, net recovery

- Lessons learned: cycle time, bottlenecks, policy gaps

INV Recovery emphasizes close-out and reporting as a core phase for turning disposition into repeatable performance.

Common pitfalls that destroy value (and how to avoid them)

- Mixing data-bearing devices into general lots → slows everything down and scares away buyers

- Missing accessories and documentation → turns “resale” into “parts only”

- Assuming “wipe = done” without evidence → weakens HIPAA defensibility

- Using partners who blur servicing vs. remanufacturing → creates regulatory ambiguity

- Overlooking batteries and hazmat shipping → last-minute logistics rework

FAQs

Do we need a Business Associate Agreement (BAA) for liquidation vendors?

If the vendor handles PHI/ePHI on your behalf (including during disposal), HHS notes covered entities may use a business associate for disposal, but the relationship must include required safeguards and agreements.

Is HIPAA satisfied if we just remove the hard drive?

Not automatically. The Security Rule requires policies/procedures for final disposition of ePHI and/or the hardware/media on which it’s stored. Your standard should specify acceptable methods and require documentation.

How do we handle patient-contact devices?

Coordinate with infection prevention/biomed and follow internal policy and manufacturer instructions; CDC guidance emphasizes ensuring equipment can be properly cleaned and disinfected/sterilized (or repaired/removed from use).

What’s the practical meaning of “remanufacturing” vs. “servicing”?

FDA defines remanufacturing in a way that centers on significant changes to performance/safety specs or intended use, and treats it differently than servicing. This is why vendor qualification and contract terms are critical.

How this fits INV Recovery and its members

INV Recovery exists to help professionals redeploy, recondition, resell, reclaim, and recycle surplus assets—and to do it in ways that improve ROI and reduce operational risk.

If your healthcare liquidation program needs stronger vendor coverage (appraisal, auctions, ITAD, recycling, environmental services), the IRA Member Service Directory is designed to help IR teams find specialized partners.

Disclaimer

For informational purposes only. This article does not provide legal, regulatory, cybersecurity, medical, or tax advice. Requirements and best practices vary by jurisdiction, facility type, device category, payer/contract obligations, and internal policies. Always consult your compliance, privacy/security, biomed, infection prevention, EHS, and legal teams, and follow manufacturer instructions and applicable laws/regulations.