What Is Investment Recovery? The Complete 2026 Guide

A pillar guide by the Investment Recovery Association (IRA) for CFOs, procurement, operations, IT, EHS, and sustainability leaders who need auditable value recovery”

TL;DR

- Investment recovery is the professional, governed process of turning idle, surplus, obsolete, and end-of-life assets into measurable cash recovery, cost avoidance, risk reduction, and sustainability outcomes.

- In 2026, best-in-class programs treat IR as a value-governance function: redeploy first, route assets with rules, prove chain-of-custody, and report outcomes (finance + ESG + compliance).

- Investment recovery overlaps with asset disposition and liquidation—but IR is the broader discipline that prioritizes reuse and total value, not just sale proceeds.

- Major segments include ITAD, industrial equipment liquidation, government surplus, and MRO/spare parts.

- If you’re starting (or rebooting) a program: build governance, set KPIs, standardize the process, and use vetted specialists from the IRA Member Service Directory.

What is Investment Recovery?

Investment recovery is the disciplined, professionally managed process of identifying and governing surplus and end-of-life assets so an organization can recover value (cash), avoid costs (reuse/redeployment), reduce risk (compliance and data security), and support sustainability (reuse/recycle with evidence).

In practice, investment recovery is a business function that sits at the intersection of finance, procurement, operations, IT, EHS, and ESG—ensuring assets follow the best “value path” (redeploy, resell, recycle, etc.) with audit-ready documentation.

Investment Recovery Definition (Meaning, Explained)

Plain-English definition

When equipment, inventory, materials, or technology are no longer needed, they become “stranded value.” Investment recovery is how organizations turn that stranded value into documented outcomes—through reuse, resale, recycling, or responsible disposition—rather than letting it sit, decay, or become a liability.

Academic / professional roots

Investment recovery has long been recognized as a structured discipline of managing surplus materials and assets as part of broader inventory and asset lifecycle strategy. It has evolved from “scrap and sell” to a governance-driven model that includes redeployment, resale channel strategy, compliance controls, and sustainability reporting.

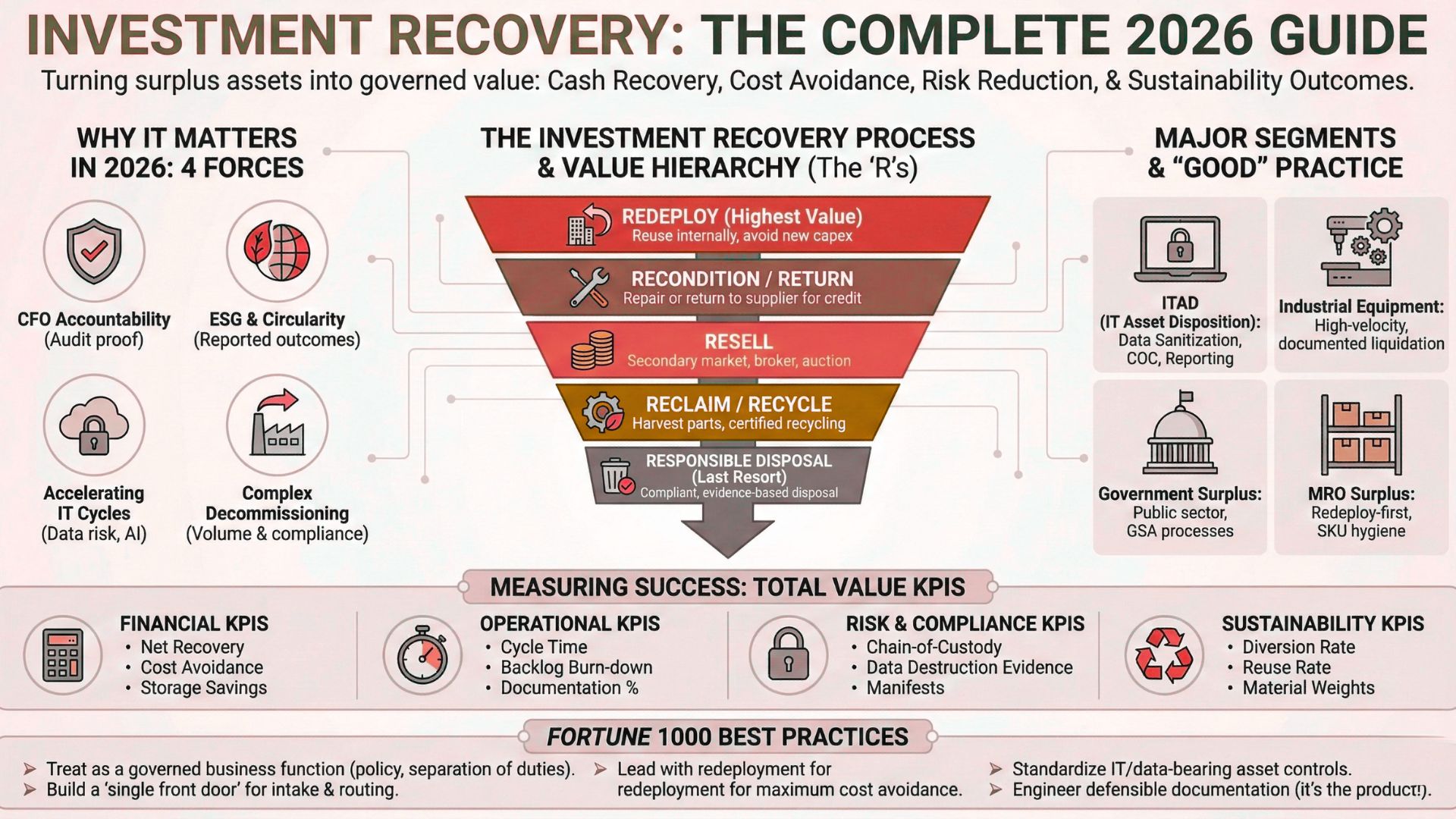

How IRA frames the value hierarchy (the “R’s”)

Modern IR programs prioritize higher-value outcomes before lower-value disposal—starting with internal reuse and only moving to recycling or disposal when value, safety, and compliance conditions require it.

- Redeploy (reuse internally)

- Recondition (repair/refurbish for reuse)

- Return (to supplier where applicable)

- Resell (secondary market)

- Reclaim (harvest parts/materials)

- Recycle (certified, documented recycling)

- Responsible disposal (when required, with compliance evidence)

Investment Recovery vs Asset Disposition vs Liquidation (Clear Definitions)

| Term | What it usually means | Primary goal | Where it fits |

|---|---|---|---|

| Investment Recovery | A governed discipline that routes surplus assets to the best value outcome and proves results with documentation. | Total value: cash + avoidance + risk + ESG impact. | Umbrella function (strategy + process + controls + reporting). |

| Asset Disposition | The operational process of removing assets from use and transferring them via sale, redeployment, donation, recycling, or disposal. | Execute retirement/disposal correctly and efficiently. | A key component within IR (execution layer). |

| Liquidation | Selling surplus/returned/overstock goods (or used assets) through secondary markets, auctions, or bulk buyers. | Convert goods/assets to cash quickly. | One channel IR may use (not the whole discipline). |

Quick takeaway: liquidation is a channel, asset disposition is a process, and investment recovery is the managed discipline that governs both to maximize total value and defensibility.

Why Investment Recovery Matters in 2026

In 2026, organizations are under pressure to do more with less: capital discipline, rising compliance expectations, cybersecurity risk, and ESG reporting scrutiny have made surplus assets a strategic issue—not a backroom cleanup problem.

Four forces reshaping IR programs

- CFO-grade accountability: leadership wants auditable proof—net proceeds, cost avoidance, and risk controls that stand up to audit.

- ESG and circularity expectations: reuse and diversion are increasingly measured and disclosed; “trust me” is no longer enough.

- IT refresh cycles (AI + security): data centers and endpoints churn faster, and data-bearing assets require stronger sanitization evidence.

- Decommissioning complexity: plant closures, facility upgrades, and project-based surplus can involve thousands of line items and significant compliance exposure.

If you manage procurement, operations, IT, EHS, finance, or sustainability: investment recovery is how you turn surplus into a governed value stream instead of a recurring headache.

Market Overview: Why Surplus Channels Are Bigger Than Most People Think

Investment recovery lives inside a broader ecosystem of secondary markets, auctions, liquidators, ITAD providers, recyclers, and surplus specialists.

The liquidation ecosystem at scale

One widely cited benchmark shows the U.S. liquidation market for liquidated goods more than doubled from 2008 to 2020, reaching $644 billion (based on Colorado State University data referenced by major industry operators). That number reflects the size and momentum of secondary markets that IR teams rely on when reselling surplus.

ITAD growth is its own engine

IT Asset Disposition (ITAD) is a major segment within surplus asset management. Market research estimates place the global ITAD market at ~$25.3B (2024) and ~$28.3B (2025), with strong growth projected through 2030. Whether you use those exact figures or not, the direction is clear: ITAD is growing because data risk, e-waste volumes, and refresh cycles keep accelerating.

Important: Market sizing varies by definition (goods liquidation vs. asset liquidation vs. ITAD services). In IR practice, what matters is building a repeatable routing process that reliably captures value and proves compliance—regardless of market labels.

Key Investment Recovery Segments (and What “Good” Looks Like)

1) ITAD (IT Asset Disposition)

What it covers: laptops, servers, networking gear, storage, mobile devices, and data-center infrastructure retirement.

What “good” looks like in 2026:

- Standardized data sanitization aligned to recognized guidance (e.g., NIST media sanitization principles) with serialized certificates.

- Chain-of-custody from pickup through processing and final downstream disposition.

- Certified environmental stewardship (commonly recognized third-party standards are often requested in vendor due diligence).

- Transparent financial reporting: gross proceeds, fees, net recovery, and disposition outcomes by asset class.

Explore IRA’s ITAD resources hub here: The Complete Guide to ITAD (IRA).

2) Industrial Equipment Liquidation

What it covers: manufacturing lines, plant equipment, electrical gear, fleet assets, spares, and project surplus from expansions and closures.

What “good” looks like: a documented process for identification, valuation, channel selection, and close-out—plus the ability to run high-velocity, high-volume dispositions without losing control of compliance evidence.

Related IRA guide: Equipment Liquidation: How to Maximize ROI.

3) Government Surplus (Public Sector)

What it covers: federal/state/local surplus property—everything from furniture to vehicles and specialized equipment.

What “good” looks like: compliance-first disposition programs with clear eligibility, routing, and transparency. In the U.S., the General Services Administration (GSA) plays a central role in the federal personal property disposal ecosystem, including auctions and other disposal mechanisms.

IRA overview: Browse IRA Articles and search “Government Surplus Auctions.”

4) MRO Surplus (Maintenance, Repair & Operations)

What it covers: spare parts, valves, bearings, motors, consumables, and storeroom inventory that becomes excess due to design changes, project cancellations, or overbuying.

What “good” looks like:

- Redeploy-first governance tied to maintenance planning and reliability engineering.

- SKU hygiene: accurate descriptions, condition grades, and packaging standards.

- Route-to-market playbooks for branded spares, commodity items, and scrap streams.

The Investment Recovery Process (Step-by-Step)

Different organizations use different terminology, but high-performing IR programs follow a repeatable structure that can be audited and scaled.

Step 1: Identify surplus (and prove ownership)

- Define what qualifies as surplus (idle vs. obsolete vs. end-of-life vs. project surplus).

- Verify title/ownership, restrictions (ITAR/EAR, regulated materials), and internal redeployment eligibility.

- Standardize intake (forms, photos, serials, location, condition, hazards, data-bearing flag).

Step 2: Evaluate condition + value + risk

- Condition grading (working, repairable, salvage, scrap).

- Market demand checks (broker quotes, auction comps, marketplaces).

- Compliance overlay (hazmat classification, export rules, data security requirements).

Step 3: Route using a “value hierarchy”

Route assets to the best outcome in this order (typical):

- Redeploy internally (cost avoidance)

- Return to supplier (contract terms)

- Resell (direct, broker, auction, marketplace)

- Reclaim parts/materials

- Recycle (certified, documented)

- Dispose (only when required, with evidence)

Step 4: Execute disposition (with controls)

- Use approved channels and vetted partners (contracts, SLAs, insurance, downstream controls).

- Require documentation: bills of sale, certificates (data destruction / recycling), manifests where applicable.

- Close-out asset records: ledger updates, write-offs, transfer-of-control confirmation.

Step 5: Report total value (not just sales)

Best-in-class programs track total value:

- Cash recovered (net proceeds)

- Cost avoided (redeployment/return)

- Risk reduced (documented compliance + data security)

- Sustainability impact (diversion, reuse, recycled weight, evidence)

Fortune 1000 Best Practices (What Top Programs Consistently Do)

1) Treat IR like a governed business function

- Clear policy: who declares surplus, who approves routing, who controls vendors.

- Segregation of duties: reduce fraud risk and improve audit defensibility.

- Standard KPIs with monthly reporting.

2) Build a “single front door” for surplus

High-performing programs stop the chaos (random disposals, unmanaged scrap, ad hoc sales) by creating a single intake mechanism—then routing with rules.

3) Lead with redeployment (cost avoidance is often the biggest win)

Redeployment can create outsized value because it avoids new capex. The key is making it easy and fair (chargeback rules, simple request workflows, condition standards).

4) Standardize IT/data-bearing asset controls

- Make “data-bearing” a required field at intake.

- Standardize sanitization outcomes and evidence retention.

- Vet ITAD partners with proof of downstream controls and documentation quality.

5) Use channel strategy (not “one-size-fits-all”)

Auction, broker, marketplace, direct sale, scrap, donation—each has tradeoffs across speed, price, confidentiality, and compliance. Mature programs decide channel based on asset class and objective, not habit.

6) Engineer documentation like a product

The best IR leaders don’t treat documentation as paperwork. They treat it as the product that makes recovered value defensible—especially for auditors, regulators, cybersecurity stakeholders, and ESG reporting.

KPIs: How Investment Recovery Teams Prove ROI

To “own” the investment recovery definition in search, it helps to be specific about how professionals measure success. In 2026, mature programs track four categories of value:

Financial KPIs

- Net recovery (gross proceeds − fees − logistics)

- Recovery rate (net proceeds ÷ original cost or replacement value; define consistently)

- Cost avoidance (redeployment savings and returns credits)

- Storage cost reduction (space, security, insurance, maintenance)

Operational KPIs

- Cycle time: surplus declared → disposition completed

- Backlog burn-down: value and volume of stranded assets reduced

- Documentation completeness: percentage with required evidence

Risk & compliance KPIs

- Chain-of-custody coverage

- Data destruction / sanitization evidence for data-bearing assets

- Regulated waste manifests / certificates where applicable

Sustainability KPIs

- Diversion rate: reuse + recycle vs landfill

- Reuse rate: redeployment + resale outcomes

- Material recovery: weights by stream (metals, plastics, e-waste)

Pro tip: Build one “Total Value” scorecard: Total Value = Net Cash + Cost Avoidance + Risk Avoidance + Verified Sustainability Outcomes. This is how IR becomes boardroom-relevant.

Need Help Implementing Investment Recovery?

IRA is a professional association dedicated to investment recovery and surplus asset management. If you’re building or upgrading a program, the fastest path is to learn from peers and work with vetted specialists.

Explore the IRA Member Service Directory (Primary CTA)

Learn about CMIR Certification

Browse IRA Articles & Best Practices

Tip for content strategy: add a short form above the directory link (name, email, company, asset type) to improve conversion-to-lead while still giving immediate access.

Career Pathways in Investment Recovery (and Why CMIR Matters)

Investment recovery is a cross-functional career path. Many practitioners come from procurement, supply chain, facilities, operations, accounting, IT asset management, EHS, or sustainability.

Common roles that touch IR

- Investment Recovery Manager / Surplus Asset Manager

- Asset Disposition Lead (industrial or IT)

- IT Asset Manager / ITAD Program Manager

- EHS / Environmental Compliance Partner (for regulated streams)

- Finance / Fixed Asset Accounting (retirement, write-off, governance)

CMIR certification (Certified Manager of Investment Recovery)

The CMIR is IRA’s professional certification designed for practitioners who want to demonstrate competency in IR governance, best practices, and professional standards.

Want to explore opportunities? Visit the IRA Job Board: Investment Recovery Jobs.

Getting Started: A Practical 30–60–90 Day Plan

First 30 days: establish control

- Document your current disposal paths (who sells, scraps, recycles, donates, disposes).

- Set a single intake mechanism for surplus (even if it’s simple at first).

- Create a minimum documentation standard (photos, serials, condition, hazards/data flag, approvals).

- Pick 3 KPIs to report monthly: net recovery, cost avoidance, cycle time.

Days 31–60: build the routing engine

- Define asset classes and approved channels (redeploy / resale / recycle / dispose).

- Standardize valuation methods and approval thresholds.

- Vet vendors and contracts; require evidence outputs (certificates, manifests, bills of sale).

- Launch a pilot on one “high pain” backlog (e.g., IT endpoints, MRO spares, project surplus).

Days 61–90: scale and prove value

- Expand intake to more departments and locations.

- Improve documentation completeness and cycle time.

- Publish a quarterly “Total Value” report to leadership.

- Benchmark your program and build a business case for tools/headcount.

Video: “What Is Investment Recovery?”

If you prefer, add a second embed that contextualizes the secondary market / liquidation ecosystem (e.g., CNBC’s coverage of the $644B liquidation market).

Explore More IRA Guides (Internal Links Hub)

- 2026 Investment Recovery Trends: What’s Changing in Surplus Asset Management

- Asset Disposition Explained: How to Maximize Investment Recovery

- The Ultimate Guide to Investment Recovery

- The Complete Guide to ITAD (IT Asset Disposition)

- Equipment Liquidation: How to Maximize ROI

- IRA Articles & Best Practices (Browse all)

FAQs

What does “investment recovery” mean in simple terms?

It means turning surplus or end-of-life assets into measurable value—cash recovery, cost avoidance, and risk reduction—using a governed process with audit-ready documentation.

What types of assets fall under investment recovery?

Common categories include IT hardware, industrial equipment, fleet assets, MRO spare parts, materials, returned goods, inventory, furniture/fixtures, and project surplus from closures or upgrades.

Is investment recovery the same as liquidation?

No. Liquidation is one resale channel. Investment recovery is the broader discipline that prioritizes higher-value outcomes (like redeployment) and proves results through controls and documentation.

How do IR teams measure ROI?

They track net proceeds, recovery rates, and cost avoidance (redeployment/returns), and increasingly include risk and sustainability outcomes in a “Total Value” scorecard.

What should I require from ITAD vendors?

At minimum: documented chain-of-custody, documented media sanitization/destruction aligned to recognized guidance, downstream control evidence, and clear financial reporting (gross, fees, net, disposition outcomes).

How can I find reputable vendors?

Start with the IRA Member Service Directory and evaluate partners using a scorecard: documentation quality, certifications, insurance, downstream controls, pricing transparency, and reporting.

Sources & Further Reading

- About the Investment Recovery Association (IRA)

- Investment Recovery Then & Now (IRA)

- IRA Member Service Directory

- CMIR Certification (IRA)

- Liquidity Services on the $644B liquidation market (CSU-referenced)

- Grand View Research: ITAD Market Size

- NIST SP 800-88 Rev. 2 (Media Sanitization)

- GSA Personal Property Management (Government surplus ecosystem)

Note: WordPress may restrict inline scripts depending on your theme/plugins. If your site blocks schema scripts, add FAQ schema via an SEO plugin (Rank Math/Yoast) using the same questions below.